Failure to receive a tax bill does not exempt a property owner from interest on delinquent taxes. If the 10 th falls on a weekend or a holiday, payment is accepted on the next business day without penalty. There is a 10 grace period and payments must be received in the Tax Collector’s office by the close of business day on the 10 th in order to avoid interest charges unless the grace period is extended by a Resolution adopted by Council in accordance with New Jersey State Law.

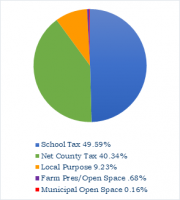

Due dates for each quarter are printed on the bill, February 1, May 1, August 1, and November 1. The bill you receive has the third and fourth quarters of the current year and the first and second quarters of the following year. Tax bills are mailed once a year during the summer. Bill will be receipted and returned.Ģ022 Tax Rate $2.981 per $100 of Assessed valuation:Ĭounty Rate (includes Library and Open Space) Payments: By mail, send check with appropriate payment stub. There is a 10 day grace period from each of the above dates after which interest is charged at the rates of 8% for balances of less than $1,500.00 and 18% for balances in excess of $1,500.00, charged from the original due date.Īnnual Tax Sale: During the last quarter of the year. You should complete this form and include it with your tax payment. For those residents who are making any pre-payments on their taxes, our office requires that you specifically provide us with exactly what the pre-payment should be applied to.

PREPAYMENT OF TAXES - The Lawrence Township Tax Collector Office accepts pre-payment of property taxes. The office also is responsible for the billing and collection of sewer user fees. The Tax Collector is responsible for the billing and collection of all funds raised by taxation or assessed to property owners for county, school, and municipal purposes. If you are interested in payment plan you must contact the Tax Collector’s office prior to Maat 60 or email the Tax Collector at. The new Law also provides for a payment plan to be offered on sewer only for those delinquent on their 2021 sewer. This Law affords a waiver of interest on 2021 delinquent sewer effective Januthrough the extended grace period of March 15, 2022. The Mercer County Prosecutor's Office has issued a warning about the existence of a Property Tax Scam.Īnnouncement: Senate Bill S4081 was signed into Law Decemfor Covid-19 relief measures regarding sewer. CALL 60 FOR ALL QUESTIONS REGARDING PROPERTY TAXES AND SEWER BILLS.ģRD QUARTER 2023 ESTIMATED TAXES WILL BE DUE BY SEPTEMBER 5TH.

0 kommentar(er)

0 kommentar(er)